Go Take a (Rate) Hike

California's Race to the Bottom

Bread and Circuses

On March 20, the California Public Utilities Commission (CPUC) held a hearing on Southern California Edison’s (SCE) plan to raise electricity rates over the next four years. The virtual town hall was marred from the get-go by administrative errors — some members of the public were mistakenly informed that the meeting would take place in-person at a Long Beach municipal building, driving miles out of their way in notoriously bad traffic, only to find an empty venue. Others received an e-mail notification erroneously printed with an incorrect agenda item, leading them to believe the day’s topic was to discuss the imminent removal of AT&T’s landline infrastructure . An embarrassingly incompetent start to a forum designed to promote public dialogue and transparency in governance. What followed was a two-hour session of scathing testimony by irate ratepayers opposing the proposed increases to their monthly bills — already some of the highest in the nation.

In its application to the CPUC, SCE requested to increase rates and revenue by $1.895 billion in 2025, with subsequent increases of $619 million in 2026, $664 million in 2027, and $705 million in 2028. For 2025, this increase would bring SCE’s total revenue requirement to $10.27 billion, representing a rate increase of 22.7% over 2024. For the average customer, the electricity bill would rise by about $17.50 per month in 2025, with ~$5/month incremental increases over the next three years. However, many ratepayers, especially in the more rural and mountainous areas, would likely pay far more.

Whenever the investor-owned utilities (IOUs), including SCE, Pacific Gas and Electric (PG&E) and San Diego Gas & Electric (SDG&E) come before the CPUC hat-in-hand, they must at least feign justification for robbing their ratepayers blind improving essential services. In this instance, SCE appealed to the increase in costs of performing operational duties, as well as to the need to invest in capital expenditures to replace and build out transmissions infrastructure, improve cybersecurity systems, and perform preventative maintenance on equipment deemed to be at risk of wildfire damage. The CPUC, ever the dutiful lapdog, almost always complies.

Which brings us back to the dog-and-pony-show public comment hearing. Facetiousness aside, the opinions and personal stories aired during the forum were truly moving and, at times, rage inducing. An elderly woman in Long Beach said she already depended on family to help her with monthly utilities, and was unsure about how much more they could afford. Retired and on a fixed income, she pointedly added that this is “how people become homeless.” Many other senior citizens lodged similar complaints. A mother of young children said she had to cut back on groceries and other essential items just to keep the lights on. Customers living in desert and mountain communities (where transmission is more expensive) reported paying hundreds of dollars on monthly bills, with minimal heating and AC usage. Others demanded a more fulsome accounting detailing exactly how Edison plans to spend the extra revenue, other than to line the pockets of executives and boost the company’s stock price. Palpable across comments from people of all walks of life was a deep sense of feeling nickel and dimed by the soaring costs of living in the Golden State.

We Are Not Entertained

Zooming out with a wider lens, California on average has the third highest electricity rates in the nation, behind only Hawaii and Rhode Island. According to a study by The Transparency Foundation, California’s rates are 67.1% higher than the national average.

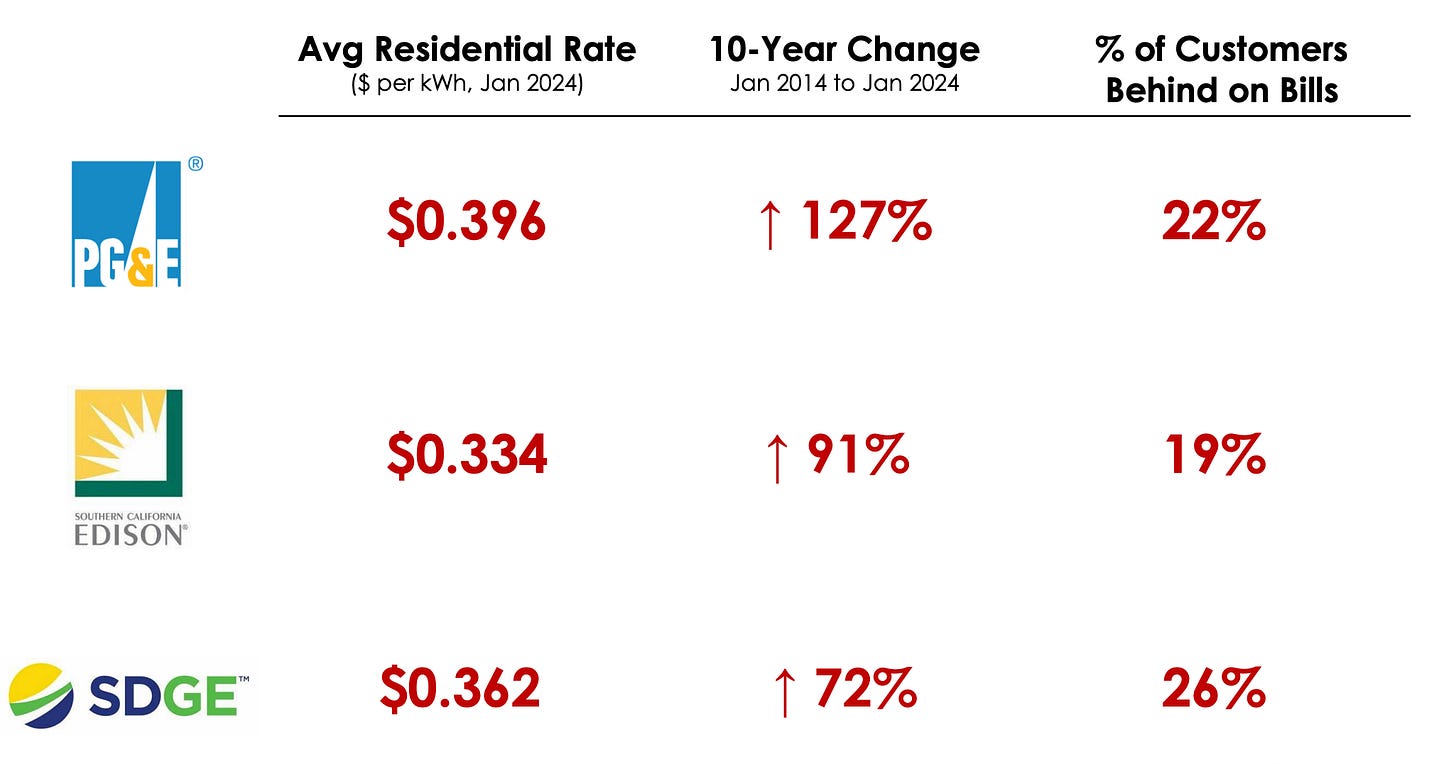

However, the state’s average is tempered somewhat by regions served by municipal utilities, which, in general, have lower rates than the three IOUs. Zooming in on the IOU territories (serving some 75% of California residents), a different picture emerges. As shown in the graphic below, all of the IOU average rates were above $0.30/kWh as of January 2024, with PG&E closing in on $0.40. What’s more, around 25% of customers served by the IOUs are behind on their bills. When nearly a quarter of California state residents cannot afford electricity, something has gone seriously wrong.

SCE is not the only California IOU flirting with steep rate hikes. PG&E has received authorization from the CPUC to raise rates twice just within the past year. A hike going into effect on January 1 increased customer monthly bills by 13% (about $34 on average). Another increase approved in early March will tack $5 more on average onto customer monthly bills, beginning later this year. PG&E claims the money is necessary to undertake the expensive and arduous process of burying their electric lines — a measure resulting from the company’s inability to mitigate the risks of wildfires to above-ground transmission. Many speculate that the revenue will also be used to deal with lingering financial woes of PG&E’s Chapter 11 bankruptcy, declared in the aftermath of the deadly Camp Fire caused by the company’s neglected transmission tower equipment. A fresh infusion of cash would also help to shore up PG&E’s bond rating, still trading below investment grade.

Complicating the situation is the relative opacity characterizing CPUC operations. Rarely ever challenging IOU-initiated rate increase applications, the CPUC has long been accused of serving as little more than a rubber stamp and cozying up to the utilities it is supposed to regulate. The Commission does not require utilities to disclose detailed plans accounting for their expenditures to the public. And, even when asked for documents under the Freedom of Information Act and Public Records Act, the CPUC is slow to respond to journalists and concerned citizens, if they respond at all. This lack of transparency makes it difficult to hold the IOUs to account for misallocation of funds and cost overruns. In fact, in signing AB-1054, Governor Gavin Newsom explicitly authorized utilities to recoup excess spending from their customers after the fact. Ostensibly establishing a $2 billion fund for wildfire mitigation, the bill allows PG&E to hold cost overruns in “memorandum accounts,” and directs the CPUC to retroactively bill customers. With no caps on overspend or annual rate hike limits, the utility is essentially allowed to write a blank check to itself, at the expense of ratepayers.

CPUC policies allow other dubious billing practices as well, operating as “hidden state taxes.” The Transparency Foundation investigated the rate cases submitted by the IOUs in 2021, uncovering $4.5 billion (equaling a 10% surcharge) in charges for government programs hiding in customer utility bills. These programs mainly support efforts mandated by California’s SB 100, requiring net zero buildings by 2045. Such initiatives include solar incentive programs, demand response, and general energy efficiency programs. While electricity bills generally include a line item for these “public purpose programs” (PPP), customers are not fully informed about how these funds are allocated or what specific purpose they serve.

Renewable energy programs are expensive investments, with the effect of driving up electricity prices (at least in the immediate term). The costs of upgrading and expanding transmission to handle an increasingly all-electric load, combined with large scale projects to construct wind farms, utility solar, battery storage systems, and demand response load shedding programs all contribute to the already-heavy burdens faced by California ratepayers. Indeed, in 2022, the CPUC unanimously approved a plan to install 25.5GW of renewables and 15GW of storage through 2032, to the tune of $49 billion. Moreover, the intermittent nature and relative low power density of wind and solar generation means that many units must be built to match just one natural gas or nuclear plant. And, with such a strong incentive to build as much as possible in pursuit of green dreams, it is hard to see how the IOUs would not seek to maximize profit by building excessively, all while sticking the ever-mounting expense to the consumer.

In a written comment to the CPUC regarding the recent SCE rate case, one respondent took the Commission to task over the soaring profits reaped by Edison International (SCE’s parent company). With an increase of 96% in net income year-over-year in 2023, and its revenue expected to increase by about 5% p.a. over the next three years, Edison is hardly slumming it. The official mandate of the CPUC is “to protect consumers and ensure the provision of safe, reliable utility service and infrastructure at reasonable rates.” Nowhere in that line do I see any requirement to fund the champagne budget of Edison’s CEO. Cheers.

Electrically yours,

K.T.

Great article and title